40 Hours Lost Every Month? Why Most Singapore SMEs Pick the Wrong Payroll Option

Singapore’s startup ecosystem is built on speed, efficiency, and innovation. But while founders sprint toward product-market fit, manual payroll often lurks in the background, quietly draining resources, risking non-compliance, and consuming over 40 hours a month in admin work and error resolution.

This guide breaks down the real cost of in-house payroll, reveals when outsourcing becomes the smarter financial and operational decision, and shows how startups can unlock time, trust, and traction through payroll automation.

The Hidden Costs of In-House Payroll

Manual payroll might seem manageable for a team of two or three, but as your headcount crosses five, the administrative burden compounds fast especially in Singapore’s compliance-heavy landscape.

1. Salary Calculations: Precision Under Pressure

Singapore’s Employment Act requires proration for incomplete work months, calculation of overtime pay (at 1.5x), and adherence to rest day regulations. This gets complex fast especially if you:

Manage shift workers with variable hours

Offer performance bonuses or commission-based structures

Need to handle partial-month joiners or leavers

Example Calculation: Salary = (Monthly Gross / Total Working Days) × Paid Days Worked

Estimated Time Drain: 4–6 hours per month

Common Pitfalls: Overlooked OT hours, wrong proration logic, delayed payslip issuance

Even a single miscalculation could result in back pay disputes that eat up 6+ hours to investigate and resolve especially in a 10-person team.

2. CPF & SDL Submissions: The Juggling Act

Employers must split CPF contributions (20% employee / 17% employer for under-55s) and submit SDL at 0.25% of wages (capped at $11.25/month). Sounds easy until you’re switching between:

CPF EZPay for locals

GoBusiness portal for foreign worker SDL

Bank GIRO systems like DBS IDEAL for salary disbursements

Time Drain: 3–5 hours/month

Risk Factor: Miss the 14th-of-month CPF deadline, and you face 1.5% monthly late interest, plus a $5 minimum per employee per offence.

3. Tax Filing Labyrinth: IR8A, IR21, and Beyond

Even small startups must comply with multiple IRAS obligations:

IR8A: Annual employee income reporting (due March 1)

IR21: Tax clearance for foreign employees before departure

Form B1: Director salary and benefits

Time Drain: 3+ hours/quarter

Penalty Risk: Up to $5,000 in fines for incorrect or late filing

If you're enrolled in the Auto-Inclusion Scheme (AIS), which is mandatory once you hit 5 employees, all filings must be electronic, correctly formatted, and on time.

| Company Size | In-House Cost (HR Time + Software) | Outsourced Cost (ElevatePayroll) |

|---|---|---|

| 5 employees | $1,125 (HR time) + $200 software | $125–$250/month |

| 10 employees | $2,250 + $300 software | $250–$500/month |

Break Even Point: Around 4.7 employees, but you could start saving even earlier when you consider the hidden costs of manual payroll, like penalties, mistakes, and all the extra hours founders spend on admin.

What You Get with Payroll Outsourcing

Let’s break down what’s included in different service tiers:

| Feature | Basic ($15–$25/employee) | Premium ($40–$60/employee) |

|---|---|---|

| CPF/SDL Filing | ✅ | ✅ |

| IRAS Compliance (IR8A) | ✅ | ✅ |

| Leave Management | ❌ | ✅ |

| Employee Self-Service | ❌ | ✅ |

| Tax Optimization Advice | ❌ | ✅ |

| Director Equity Handling | ❌ | ✅ |

For startups with directors drawing variable compensation, or teams offering stock options, premium tiers save thousands annually by avoiding filing errors and missed deductions.

Strategic Opportunity Cost: Your Time = Startup Fuel

The 10-Hour Rule

If a founder is spending 10 hours/month on payroll instead of growth activities, that’s:

$1,500/month (assuming $150/hr post-seed valuation)

$18,000/year (equivalent to hiring a part-time growth marketer or content lead)

With outsourcing, 87% of that time is recovered. This time that could go toward:

Product iteration

Customer acquisition

Fundraising

Hiring

Employee Experience: The Often-Overlooked ROI

Manual payroll leads to:

23% higher turnover for teams under 50

2.3x more HR tickets related to salary, leave, or CPF

Friction during tax season, especially among foreign staff

By contrast, employee self-service portals (included in ElevatePayroll premium plans):

Reduce admin queries by up to 60%

Improve employee trust in pay accuracy

Streamline onboarding and offboarding

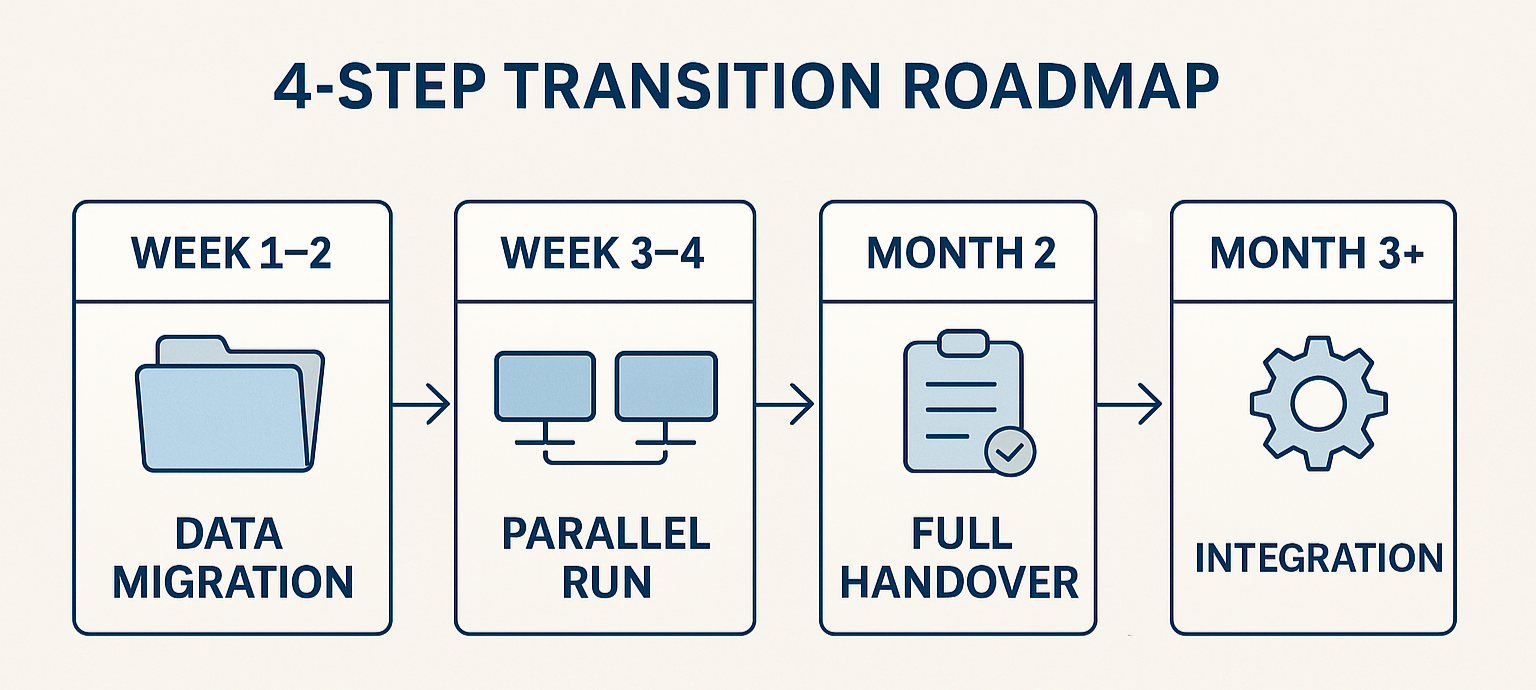

Making the Switch: A 4-Step Roadmap

Outsourcing doesn’t mean chaos. ElevatePayroll uses a structured transition approach:

Week 1–2: Data Migration

Import employee records, GIRO info, past payroll files

Week 3–4: Parallel Run

Run payroll side-by-side with current process for checks

Month 2: Full Handover

Elevate assumes complete payroll operations

Month 3+: Tool Integration

Sync with accounting platforms like Xero, QuickBooks, or ERP systems

Bonus: We also help you set up CPF, IRAS access, and GIRO arrangements if not already in place.

Elevate Your Operational Leverage

Let’s face it: managing payroll in-house is a burden disguised as a necessity. But for fast-moving startups, it's often more risk than reward.

$1,100+ saved monthly for a 5-person team

40+ hours per month returned to growth activities

Compliance anxiety eliminated

Professional-grade experience for employees

Ready to Reclaim Time and Scale with Confidence?

At Elevate Payroll, we empower Singapore startups to stop babysitting spreadsheets and start focusing on scaling.

Book Your Free Payroll Audit Today!

Includes:

Custom cost-benefit calculator

Risk exposure review

Transition roadmap

Free “Startup Payroll Optimizer” Toolkit (worth $500)

Don’t let the admin steal your momentum. Elevate your payroll, and your business, with Elevate Payroll.