Growing Pains to Growth Gains: Five Steps to Make Your Singapore Payroll System Ready for Anything

As your business in Singapore grows from a humble startup into a thriving company, handling payroll quickly becomes a whole lot more complicated. Most companies don't realize they've outgrown their payroll systems until they're already facing significant challenges – from compliance issues and calculation errors to integration problems and security concerns. In this guide, you’ll find a practical five-step framework designed to future-proof your payroll system, so it grows right alongside your business, no matter how quickly things change.

Why Do So Many Singapore SMEs Hit Payroll Snags as They Grow?

Managing payroll in Singapore isn’t straightforward. Businesses have to navigate a maze of strict rules, from CPF contributions and the Skills Development Levy (SDL) to a host of tax obligations. As companies grow, these hurdles don’t just add up, they can quickly snowball out of control. The payroll setup that runs smoothly for a 10-person startup tends to fall apart once you hit 50 or 100 employees. Things get even more complicated once you start expanding into other countries. Suddenly, you’re dealing with a whole new set of compliance rules in each place you operate.

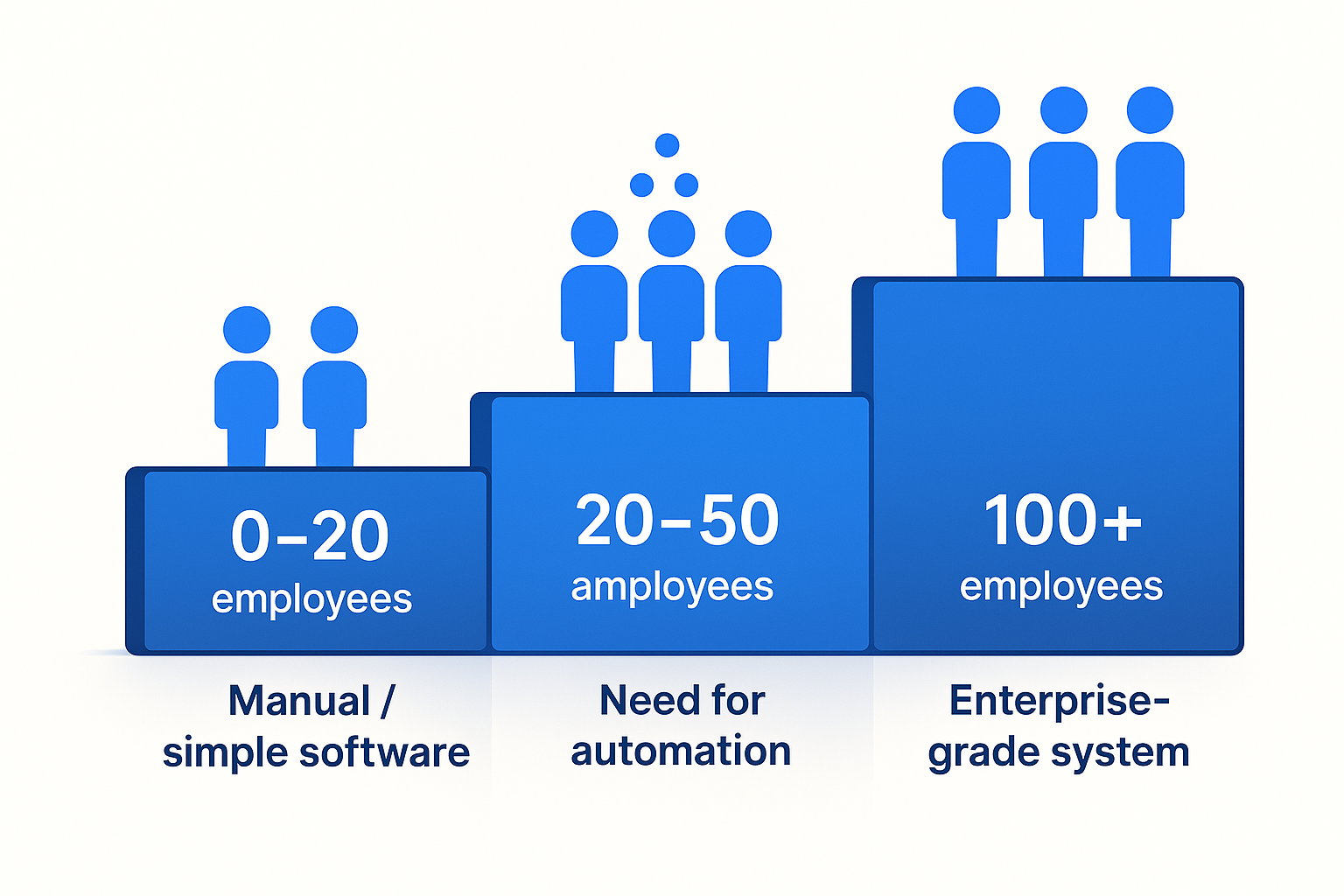

Step 1: Match Your Payroll Approach to the Size of Your Team

By knowing how your payroll needs will change as your team grows, you can get ahead of scaling headaches before they turn into major issues.

When You Have 20 Employees or Fewer

At this point, a lot of SMEs are still handling payroll by hand or relying on simple software. Handling payroll this way works fine when your team is still small, but the cracks start to show as your headcount rises. When your team is still under 20 people, you’re usually focused on things like:

Handling straightforward CPF and SDL calculations

Handling the paperwork for employment passes and work permits

Tax reporting is still pretty straightforward at this stage

Managing leave is still pretty simple at this stage

At this stage, payroll duties usually get handed to staff already wearing several hats, a recipe for mistakes and inefficiencies as things get busier. Once your team starts creeping up toward that 20-person milestone, it’s a clear signal to start looking at sturdier payroll solutions.

Once Your Team Grows Past 50 People

After your team grows beyond 50 people, handling payroll by hand just doesn’t cut it anymore. At this point, handling payroll suddenly gets a lot more complicated:

You’ll need to fully automate all your payroll calculations

Connecting your payroll with your HR management tools

Keeping close tabs on all your legal and regulatory obligations

Managing employee benefits gets a lot trickier

The ability to generate in-depth payroll reports

When your team grows, even a small payroll mistake can quickly snowball into a much bigger problem. Implementing appropriate systems at this stage is not just about efficiency, it is about risk management.

100+ Employees

At 100+ employees, your payroll system needs enterprise-grade capabilities:

Multi-country setup for regional teams

Role-based access control for payroll data

Advanced data security protocols

Comprehensive audit logging

Integration with multiple business systems

Complex tax scenario handling

Managing payroll for organizations of this size requires specialized solutions that can handle diverse employment arrangements, multiple payment cycles, and various statutory requirements across different employee categories

Step 2: Select a Scalable Payroll Platform

Choosing the right payroll platform is perhaps the most critical decision you'll make in future-proofing your payroll processes. Look for these key capabilities:

Essential Integration Capabilities

Your payroll system should seamlessly connect with:

Accounting software like Xero or QuickBooks to eliminate duplicate data entry and reduce errors

Banking systems for GIRO payroll processing

Time and attendance tracking systems

HR management software

Leave management tools

Integration capabilities become increasingly important as your business grows, helping to maintain data consistency across systems and reduce manual administrative work.

Compliance Automation

Select platforms that automatically stay current with:

CPF contribution rate changes

Tax reporting requirements

Employment Act updates

Foreign worker levy adjustments

Skills Development Levy calculations

A good payroll system will handle these compliance requirements automatically, reducing the risk of errors and penalties.

Scalability Features

Ensure your chosen platform offers:

Let employees handle routine HR tasks themselves, lightening the load for your HR team

Manage everything from your phone, wherever work takes you

Flexible user access controls

Handles different payroll schedules, whether you pay your team monthly, every two weeks, or even weekly

Able to handle all sorts of employment arrangements, whether your team is full-time, part-time, or on contract

As your organization grows, these scalability features will become increasingly important in maintaining efficient payroll operations while controlling administrative costs.

Step 3: Take the Hassle Out of Compliance and Contributions with Automation

Navigating Singapore’s regulations means keeping a close eye on countless contributions and compliance rules. Automating these processes not only cuts down on mistakes, but also helps you meet deadlines without the last-minute scramble.

Automating Required Contributions

A good payroll system should handle these calculations on its own:

CPF contribution rates that change depending on an employee’s age

Skills Development Levy (SDL)

Examples of Self-Help Group (SHG) contributions include CDAC, MBMF, SINDA, and ECF

Foreign worker levy, if it applies

The rules behind these calculations are anything but simple. They shift depending on things like an employee’s age, citizenship, and how much they earn. Calculating these contributions by hand isn’t just tedious, it’s all too easy to make mistakes, and those slip-ups can land your business with costly fines or even legal trouble.

Creating Tax Forms

Ideally, your system will handle the creation of:

IR8A forms, which detail your employees’ earnings

Appendix 8A, which covers benefits

Appendix 8B, which covers employee stock options

IR8S, which covers Ordinary Wage (OW) and/or Additional Wage (AW) in excess of the CPF contribution limit

When you automate tax form generation, you not only stay in line with IRAS regulations but also spare your HR team a huge amount of paperwork and hassle.

Keeping Track of Important Payroll Deadlines

Set up automatic reminders so you never miss those important statutory deadlines:

Deadlines each month for submitting CPF contributions

When it’s time to file your taxes each year

Deadlines for paying the foreign worker levy

Deadlines for renewing work permits

Letting these deadlines slip by can land your business in hot water with penalties and compliance headaches. With automation in place, you can rest easy knowing your business won’t miss any important deadlines or fall short of compliance requirements.

Step 4: Get Your Payroll Ready for Cross-Border Growth

Because Singapore acts as a springboard into Southeast Asia, it’s only natural that many SMEs end up branching out into nearby countries. Your payroll system needs to keep pace as your business expands.

Navigating Compliance Across Multiple Countries

Each country has its own version of Singapore’s CPF system:

In Malaysia, you'll need to handle both the Employees Provident Fund (EPF) and contributions to the Social Security Organization (SOCSO)

In Indonesia, you'll need to manage BPJS Ketenagakerjaan (for employment)

In the Philippines, you’ll need to handle contributions to both the Social Security System (SSS), Philippine Health Insurance Corporation (PhilHealth), and Home Development Mutual Fund (Pag-IBIG)

Every system comes with its own set of contribution rates, unique submission steps, and specific compliance rules to follow. An effective payroll system needs to include country-specific features that can adapt to all these different requirements.

Handling Different Currencies

Expanding into new regions brings a fresh set of headaches when it comes to managing different currencies:

Handling payroll in multiple currencies

Exchange rate management

Cross-border payment compliance

International banking integration

Your payroll system needs to handle all these currency quirks so your team gets paid correctly and in line with the rules, no matter where they are.

How Different Countries Define and Categorize Their Workers

How workers are classified varies from country to country, and that can really complicate payroll:

Different countries draw their own lines between who counts as an employee and who’s considered a contractor

Overtime pay and leave entitlements can look completely different, depending on where your employees are

Perks and allowances that vary from one country to another

Local tax rules and regulations

Because every country does things a little differently, you need a payroll system flexible enough to handle local rules without throwing your entire HR strategy out of sync.

Step 5: Get Ready for Audits and Make Security a Priority

As your business expands, keeping payroll data secure and being prepared for audits only grows more critical.

Keeping Payroll Data Safe

Make sure you choose payroll providers who adhere to strict security standards:

ISO 27001 certification, which sets the gold standard for managing information security

Encrypt sensitive payroll data both when it’s stored and while it’s being transmitted

Use multi-factor authentication to control who can get into your system

Routine security checks and thorough penetration testing

Without these security safeguards, sensitive employee data could easily be exposed, and staying on the right side of data protection laws would be nearly impossible.

Managing Who Can See and Change Payroll Data

Set up detailed access permissions:

Give each HR team member access tailored to their specific role

Sign-off processes for handling sensitive tasks

Keeping a thorough record of who did what and when

Making sure that no single person handles every step of important payroll tasks

When your HR team grows, it’s more important than ever to keep a close eye on who’s able to view, edit, or sign off on payroll data. Otherwise, you risk mistakes or changes slipping through the cracks.

Keeping Track of Changes and Maintaining Records

Make sure your system keeps thorough records of everything:

A full record of every payroll calculation ever made

A record of when policies were updated and the dates those changes took effect

A log of who approved what and when

A record of every change made to employee information

These records prove indispensable, not just when auditors come knocking or regulators require proof, but also when employees have questions about their past pay.

Final Thoughts: Put the Right System in Place Now and Save Yourself a Lot of Hassle and Expense Down the Road

The bigger your company gets, the more expensive and complicated it becomes to switch payroll systems. Implementing a scalable solution early, even if it seems like overkill for your current size, can save significant resources down the line. The disruption and compliance risks of migrating payroll data for 100+ employees far outweigh the initial investment in a robust system.

Singapore's dynamic business landscape offers tremendous growth opportunities, but only for companies with infrastructure that can scale accordingly. By following this framework, you can build a payroll foundation that supports your business ambitions rather than constraining them.

Ready to Simplify Payroll, Ensure Compliance, and Scale Your Business?

Streamline your payroll processes, stay compliant with Singapore labor laws, and grow with confidence. Elevate Payroll is your trusted partner. Whether you're a startup or an enterprise, our scalable payroll solutions adapt to your needs, backed by expert guidance on Singapore and regional compliance.

Talk to our network of HR experts today and discover how we can help your business thrive!